Filing an insurance claim used to mean long phone calls, paperwork, and waiting weeks for updates. Today, millions of Americans choose to file insurance claim online because it is faster, more transparent, and far more secure than traditional methods.

With the rise of cloud platforms, AI claim tools, and mobile apps, insurance companies now allow customers to submit claims, upload documents, and track progress in real time.

However, many people still make costly mistakes when filing online. A wrong document, missing detail, or unsecured platform can delay or even reject your claim.

In this guide, you will learn how to file an insurance claim online safely, step by step, using digital tools that meet modern security standards.

What does it mean to file an insurance claim online?

To file an insurance claim online means submitting your claim through a secure web portal or mobile app provided by your insurance company. Instead of visiting an office or calling an agent, you:

- Fill out a digital claim form

- Upload photos or documents

- Track the claim status online

- Receive updates by email or app

Most major insurers in the US now support full online claims for:

- Auto insurance

- Health insurance

- Home insurance

- Travel insurance

Benefits of filing your claim online

Here is why digital claims are becoming the standard:

- Faster processing – claims can be reviewed within hours

- Lower error rate – guided forms reduce mistakes

- 24/7 access – no waiting for business hours

- Secure document uploads

- Real-time status tracking

💡 Tip: Always use the official website or mobile app of your insurance provider. Avoid third-party claim sites.

Step 1: Gather all required claim documents

Before logging in, prepare:

- Policy number

- Date and description of the incident

- Photos or videos

- Medical or repair bills

- Police report (if required)

Having these ready will prevent claim delays.

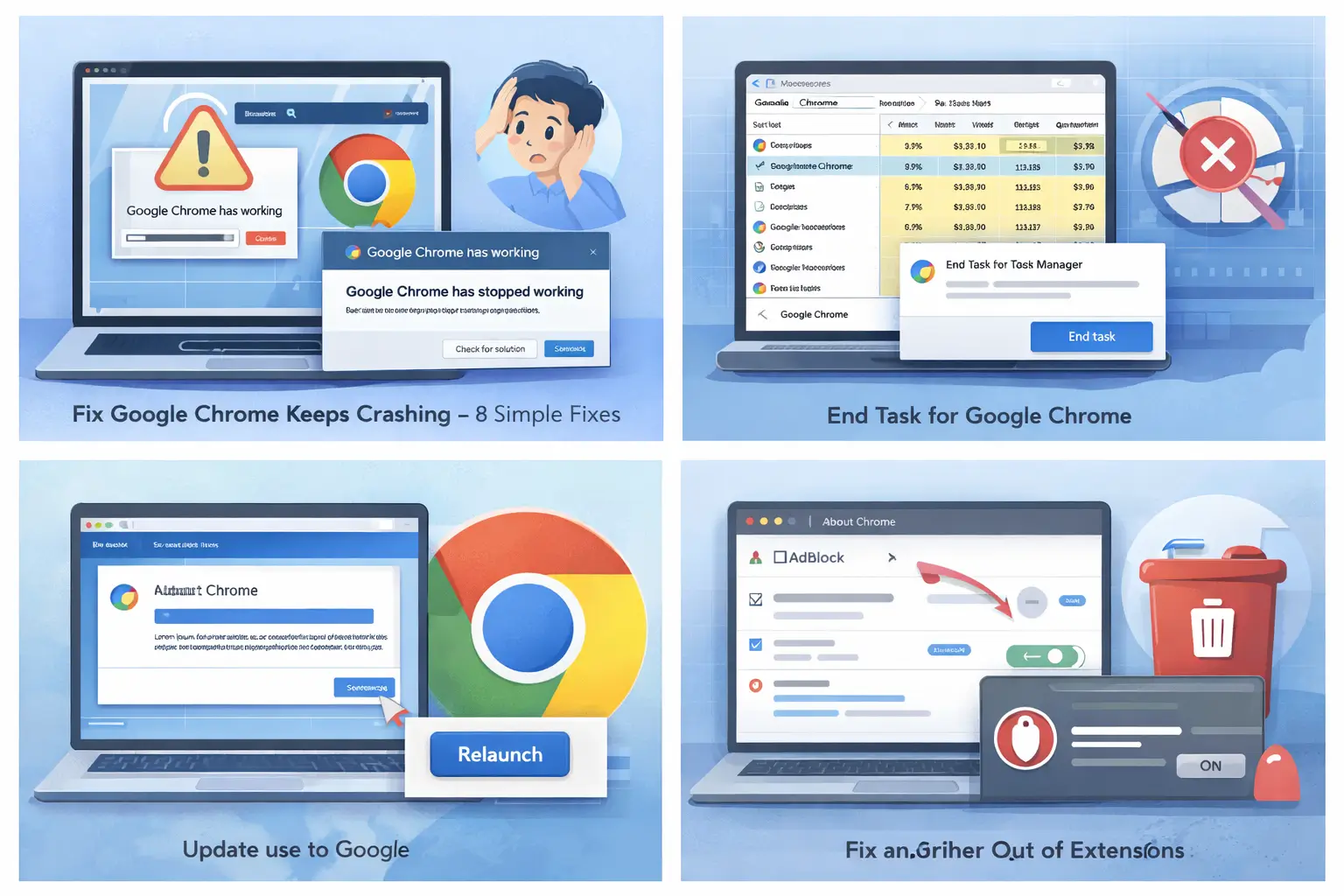

Step 2: Log into your insurer’s secure portal

Visit your insurance company’s website and find the Claims section.

Log in using your registered email and password.

Make sure the site shows:

- HTTPS in the address bar

- A lock icon

- Official domain name

🔒 Security note: Never submit claims over public Wi-Fi.

Step 3: Start a new online claim

Click “File a Claim” or “Submit New Claim.”

Choose the type of insurance:

- Auto

- Health

- Home

- Travel

Then answer the guided questions.

Step 4: Upload proof and documents

Use clear photos and scanned files.

Name each file clearly (example: repair_invoice.pdf).

Most platforms accept:

- JPG

- PNG

💡 Tip: Use a mobile scanner app for sharp document images.

Step 5: Review and submit

Double-check all information before submitting.

Errors can delay payment or cause rejection.

Once submitted, you will receive:

- Claim reference number

- Confirmation email

- Tracking access

Step 6: Track your claim online

Most insurers provide a dashboard where you can:

- See claim status

- Upload extra documents

- Message claim agents

This reduces the need for phone calls.

Common mistakes to avoid

- Submitting incomplete documents

- Using unsecured websites

- Missing deadlines

- Uploading blurry photos

- Giving incorrect incident details

How long does an online insurance claim take?

| Claim Type | Average Time |

|---|---|

| Auto | 3–10 days |

| Health | 5–15 days |

| Home | 7–30 days |

| Travel | 3–7 days |

How to protect your insurance data online

Use:

- Strong passwords

- Two-factor authentication

- Official apps only

- Private internet connections

Never share your login with anyone.

FAQ

Is it safe to file insurance claim online?

Yes, if you use official and secure platforms.

Can I file a claim from my phone?

Yes, most insurers offer mobile apps.

What if my claim is rejected?

You can appeal online with extra documents.

Final thoughts

Learning how to file insurance claim online gives you speed, control, and transparency. With secure digital tools, you can protect your data and receive compensation faster than ever before.

If you follow the steps in this guide, you can confidently submit claims and avoid common mistakes in 2026 and beyond.